- Справка

- Описание сервиса

- Быстрый старт

- Часто задаваемые вопросы

- Я оплачиваю за один счет или за весь сервис?

- Я не могу войти в личный кабинет / хочу сменить пароль

- Что если я сменил брокера или биржу, как это отразить в сервисе?

- Ознакомительная версия. Тестовый доступ

- Почему у меня не загружается отчет брокера?

- Требование к отчету для подключения

- Даты некоторых сделок в отчете старше дат, за которые данные уже загружены

- Помогите мне все настроить

- Результаты по счету не отражают действительность

- Мне не подходят указанные способы входа/выхода. Пользовательские столбцы

- Как ввести начальные позиции

- Виды подписок, отличие тарифов

- Видео часто задаваемые вопросы

- Подключенные отчеты брокеров и платформы

- Универсальный отчёт

- UX

- USA

- Журнал статистики

- Arche

- APEX

- AvalonFund Activ

- АльфаБанк (биржа СПБ)

- ATAS

- Blackwood

- bbrok

- BrokerCrediService

- CYGroup

- Colmex

- DAS

- Daytraderclub

- Exante trades

- Fondexx (sterling)

- Fondexx (Alpha Trader)

- Freedom Finance Кипр

- Freedom Finance

- Fusion

- Финам (ROX)

- GrayBox

- General Trade

- Gerchik&Co Stocks

- Lightspeed

- Interactive Brokers

- LabDea

- Laser

- MIG (Fusion)

- MB trading

- Orbis Pro Trader

- Открытие

- PPro8

- ROX

- SDG

- Sterling

- Shark Traders

- Thinkorswim

- Тинькофф Банк (биржа СПБ)

- Trade Up

- TradeSpeed

- Trader Workstation (TWS)

- TradeZero

- Takion

- United Traders

- РТС(Фортс)

- Журнал статистики

- Алор

- Альфа-банк

- Атон

- A-Lab

- ATAS

- Arche

- EasyScalp

- БрокерКредитСервис

- ВТБ24 (QUIK)

- OnlineBroker VTB24

- Газпромбанк (QUIK)

- Зенит

- IT Invest

- I-NVEST

- Кит Финанс

- MetaTrader 5

- Nettrader

- QUIK

- Открытие

- Открытие Единый счет

- Промсвязьбанк

- РИК - Финанс

- РосЕвроБрокер

- Солид

- Сбербанк

- Transaq

- TigerTrade

- TSLab

- Трейд-Портал

- Універ

- УНИВЕР Капитал

- УРАЛСИБ Кэпитал

- United Traders

- Just2Trade (Whotrades)

- Volfix

- Финам

- Церих

- ММВБ (Московская биржа фондовая секция)

- Журнал статистики

- Алор

- Алор (из терминала Алор Трейд)

- Атон

- A-Lab

- ATAS

- Альфа-банк

- БКС

- ВТБ24 (QUIK)

- OnlineBroker VTB24

- Газпромбанк (QUIK)

- IT Invest

- Церих

- Кит Финанс

- Nettrader

- Открытие

- Открытие Единый счет

- Промсвязьбанк

- Сбербанк

- Тинькофф Банк

- Трейд-Портал

- Transaq

- TSLab

- УНИВЕР Капитал

- УРАЛСИБ Кэпитал

- Финам

- Freedom Finance Кипр

- Just2Trade (Whotrades)

- FOREX

- CME

- Бинарные опционы

- Счета. Настройка счетов. Управление счетами

- Что такое счет?

- Панель управления счетами

- Создание счета

- Редактирование счета

- Активация или продление счета

- Настройки отображения данных. Как добавить/убрать столбцы в таблице сделок. Как добавить пользовательские столбцы.

- Настройка соответствия названий инструментов

- Заполнение счета демо-данными

- Создание ссылки на просмотр счета

- Связанные счета

- Сделки. Управление сделками

- Что такое сделка? Атрибуты сделки.

- Панель управления сделками

- Таблица сделок

- Редактор сделок

- Способы внесения сделок

- Алгоритмы автоматического формирования сделок

- Как ввести начальные позиции

- Загрузка отчета брокера

- Массовое редактирование сделок

- Дублирование сделок

- Объединение сделок

- Удаление сделок

- Корректировка результатов сделок

- Добавление комментария к сделке

- Добавление скриншотов к сделке

- Выгрузка сделок в Excel

- Резервные копии сделок

- СТАТИСТИКА

- Для групп трейдеров

- Дневник

- Вкладка "Профиль"

- Требования к программному обеспечению

- Условия предоставления сервиса.

- Пополнение баланса и оплата услуг

- Бонусы

- Партнерская программа

- Обучение

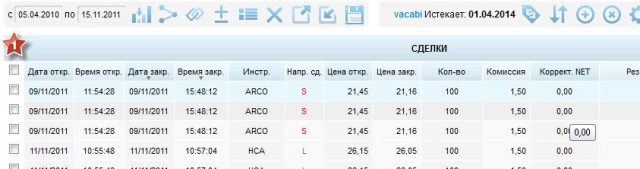

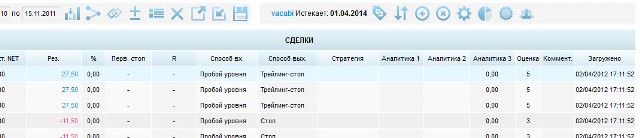

Таблица сделок

В таблице сделок хранятся все завершенные сделки со своими атрибутами

Таблица сделок формируется автоматически из транзакций отчета брокера по специальным алгоритмам или заполняется вручную с помощью встроенного редактора.

Данные таблицы сделок являются первоисточником для остальных таблиц и диаграмм.

Из отчета брокера загружаются дата и время входа/выхода в сделку, направление, цена входа/выхода, комиссия.

Дополнительные атрибуты необходимо заполнять вручную либо с помощью функций массового заполнения.

Дополнительные атрибуты необходимы для диаграмм входящих в группу "Статистика по стилю торговли"

В таблице сделок хранятся все завершенные сделки со своими атрибутами, но отображаются только те, которые попадают в период, выставленный в панели управления сделками.

Сделки отображаются постранично. Количество сделок на одной странице можно выбрать в левом нижнем углу таблицы.

При загрузке отчета период отображения сделок автоматически определяется датами, которые входят в отчет брокера.

Сделки можно отсортировать по любому атрибуту, кликнув на название колонки.

1. Чекбокс для выбора сделки. Выбранным сделкам можно проставить дополнительные атрибуты, объединить или удалить. Чекбоксы можно устанавливать только в пределах одной страницы.